Weekly Update #4: AI vs. Memecoins

Bank of America Dives into Stablecoins. Circle vs. Tether Showdown. Quantum Computing Gets Real. Memecoins Under the SEC Microscope. Citadel Enters the Crypto Arena. Claude Sonnet 3.7 & GPT-4.5 Arrive

Hey everyone, Akash here!

At ETH Denver, and the energy is buzzing!

It's clear where everyone's heads are at: building, building, building.

AI is absolutely dominating the conversation—we're talking AI agents, decentralized AI infrastructure, the whole nine yards.

Interestingly, price talk is non-existent.

Memecoins and NFTs seem like distant memories.

The big VC players and major chains are all here, though, soaking it all in.

What's Actually News?

Memecoins & the SEC:

The SEC has declared that memecoins are not securities... for now.

This could be a game-changer or just a breather. We'll be watching closely.

Stablecoin Showdown:

While memecoins are in the regulatory grey zone, stablecoins are heating up big time. Bank of America, yes, that Bank of America, is reportedly gearing up to launch its own USD-pegged stablecoin.

Total stablecoin supply just hit an all-time high of $227 billion.

Meanwhile, Circle is pushing for all stablecoin issuers to register in the US, while Tether, sitting on a massive $115 billion in U.S. Treasuries, feels like it's in the crosshairs.

Jerome Powell, Chair of the Federal Reserve, weighed in, stating:

“The Federal Reserve definitely supports efforts to create a regulatory framework around stablecoins. They may have a big future with consumers and businesses, and it’s important that stablecoins develop in a manner that protects consumers and savers, that there be a regulatory framework.”

AI Cloud Wars Heat Up:

CoreWeave, a major cloud computing force, is apparently racing towards a $4 billion IPO at a staggering $35 billion valuation. Lofty? Perhaps. Exciting? Absolutely.

👉 For deep dives into the AI x crypto world, [subscribe to Your Web3 Guy newsletter].

Top Reads This Week

AI x Crypto Investment Thesis 2025. Cyber Fund. Link

AI Promise and Chip Precariousness. Stratechery. Link

How Brands Can Win in Virtual Worlds [Podcast]. Link

Winning the Next Era of Payments. 51 Insights. Link

The Stablecoin Future. All in Podcast. Link

Stablecoins round up: Ethena, USDC, Ripple USD, USDT & fastUSD. Link

The Geopolitical Shift: Localization, Protectionism, and the New Investment Playbook. Maja Vujinovic. Link

Stablecoins: Leapfrogging Africa’s Financial System. Hashed Emergent. Link

Everything that happened in AI this week. Link

Bank of America's Stablecoin Ambition

Bank of America (BoA), the second-largest US banking giant, is making moves towards launching a US dollar stablecoin, just waiting for the regulatory light to turn green.

Why This Matters:

When a traditional financial institution of BoA's scale enters the stablecoin arena, it's a clear signal that the space is maturing and gaining mainstream traction.

Key Takeaways:

Traditional vs. Crypto-Native: Unlike stablecoins born in the crypto world like USDT and USDC, BoA's version leverages its massive customer base (100M+) and established regulatory framework. This could appeal to a more risk-averse crowd.

Digital Powerhouse: BoA handles a staggering $3 trillion in digital transactions annually and holds blockchain patents, positioning them for rapid deployment once regulations allow.

Regulation on the Horizon: Current rules are a hurdle, but bipartisan efforts like the "Clarity for Payment Stablecoins Act" could pave the way for banks to issue stablecoins as early as 2025.

BoA's entry could sway institutional players towards bank-backed stablecoins, emphasizing audits and reliable liquidity.

It also puts pressure on other financial giants like JP Morgan (with JPM Coin) and Citi to refine their own stablecoin strategies.

Bonus: MEXC is investing $20 million in USDe, a USD-pegged digital coin by Ethena Labs.

👉Work with us: Scale your corporate adoption. Reach corporate decision-makers, build investor confidence, elevate your brand, and capture market & mindshare.

The Quantum Computing Race: It's On!

This week saw major moves in the quantum computing arena:

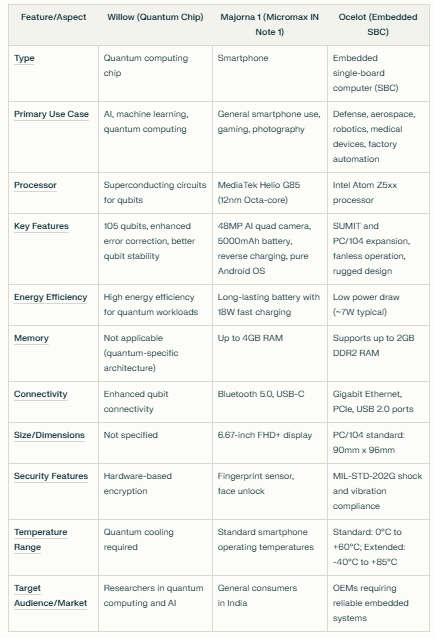

Amazon Web Services (AWS) launched its first quantum chip, Ocelot - entering the projected $50 billion quantum market.

This follows Google's December 2024 release of Willow, currently considered the fastest computing chip.

Key Highlights:

Microsoft’s Majorana 1: Focuses on error-resistant qubits, a potential breakthrough for quantum tech stability and scalability, similar to how traditional computers paved the way for smartphones.

Tech: Topological qubits (inherently error-resistant using Majorana particles)

Scale: Aims for 1 million qubits on a palm-sized chip.

Edge: Digital control simplifies operations compared to current analog systems.

Goal: Solve complex industrial problems (microplastics, self-healing materials) within years.

AWS’s Ocelot: Employs "cat qubits" to drastically reduce error correction costs (by 90%), making quantum computing more efficient and accessible.

Tech: Cat qubits (built-in error suppression).

Scale: Leverages standard microchip manufacturing for scalability and cost-effectiveness.

Edge: Prototype includes integrated error correction, aiming to accelerate practical quantum computing by 5 years.

Goal: Speed up drug discovery, climate modeling, and financial risk analysis.

The Real Race:

It's not just about qubit count; it's about scalable error correction.

Microsoft and AWS are betting on innovative physics (Majoranas/cat qubits) to potentially surpass Google's current performance lead.

How do these chips stack up against Google's Willow? The quantum race is just getting started!

🚨 Quick Hits - Don't Miss These!

Claude 3.7 Sonnet is available on Google Cloud’s Vertex AI Model Garden. Link

OpenAI announces GPT-4.5. Link

Dubai Financial Services Authority (DFSA) approved USDC and EURC. Link

Citadel Securities enters crypto trading. Link

Hamster Kombat launches gaming Layer-2 on TON. Link

Solana's first ETF made its debut on the Depository Trust & Clearing Corporation (DTCC).

💰 Money on the Move - Funding Highlights:

Ethena: Stablecoin company raised $100M led by Franklin Templeton Investments. Link

Bitwise: Crypto Index Fund & ETF Provider raised $70M led by Electric Capital. Link

Raise: Crypto reward app raised $63M led by Haun Ventures. Link

That's the rundown for this week!

Until next time,

Akash